Member Login

- Online Banking

- Premier Treasury Online

*Username

Forgot User ID*Password

Forgot PasswordNot Enrolled Yet?

Set up Online AccessNeed to complete an application?

Join MIDFLORIDA Today!

Experience the benefits of credit union membership, including low fees, great rates and personalized service. Become a member and start banking smarter with us.

Get Startede-Statements & Tax Forms

At A Glance

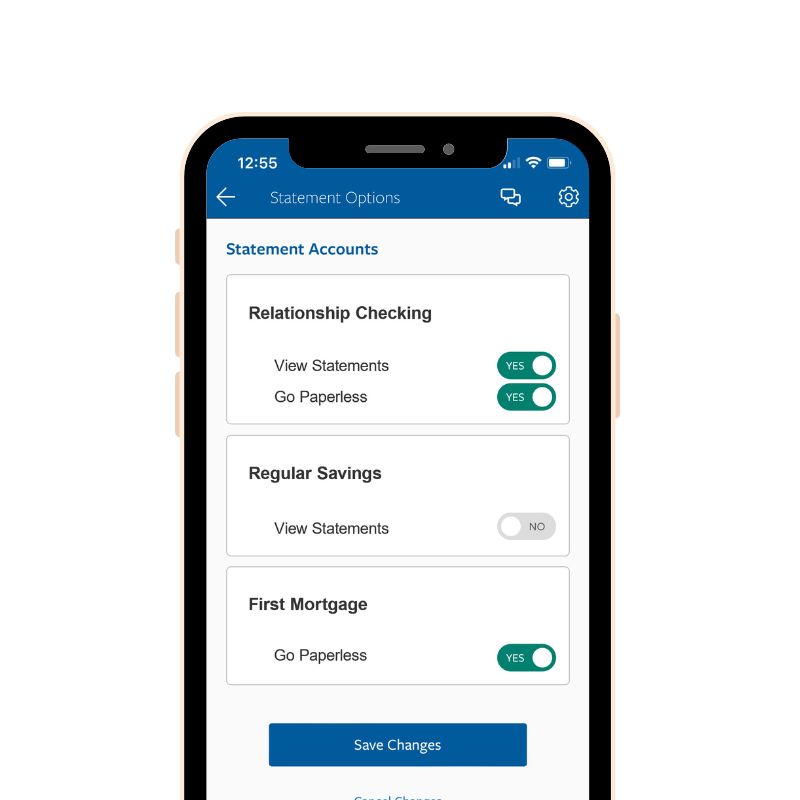

Go Paperless with Free eStatements

When you enroll in online banking, you're automatically signed up for eStatements - giving you instant access to your account statements.

Archived up to 5 Years

Loan Statements

Tax Forms

Online Tax Forms

Instant access

Secure Storage

Archived History

Tax Forms FAQs

Yes. All members who have enrolled in Free Online Banking have access to electronic tax forms. Simply log in to Free Online Banking and click the Tax Forms tab. Applicable tax forms that are available to you will appear in the drop-down menu. If you log in after tax forms are available for the prior year (generally in late January) and receive the message “No tax documents available,” then your situation did not cause a tax form to be generated for the prior year.

Note: 1099 MISC forms are not available online at this time, so if your situation generated a 1099 MISC, it will be mailed to you.

2024 tax forms mailed January 10, 2025.

Tax forms will be available by January 31 but possibly sooner. We will update this page and post an announcement on our home page when they are available.

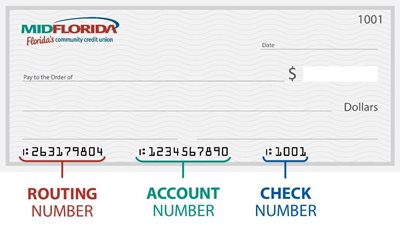

The IRS allows direct deposit as a convenient way to accept your tax return. Whether you file by yourself or hire a tax preparer, you’ll need to have your MIDFLORIDA Credit Union account and routing numbers handy to set up direct deposit for your tax refund. MIDFLORIDA's routing number is 263179804.

There are a couple of ways to find your full account number:

- In Free Online Banking

Click on the Accounts tab and select View / Edit Accounts. (Full account numbers are not available within Premier Online Banking.) - In the Mobile App

Tap the Profile cogwheel and select My Information. - On your checks

For checking accounts, you can use your MICR number. This can be found on the bottom of your MIDFLORIDA checks between the routing number and the check number. See example below.

A 1099 is used for sources of income other than salary and wages, and it’s important to note that not all 1099 forms are the same. While a 1099-INT form is used for reporting interest income, a 1099-MISC is used for just that…miscellaneous income.

These forms are generated for our members only if the following income criteria are met:

- 1099 INT – interest earned totaling $10 or more

- 1099 MISC – Prize winnings totaling $600 or more

- 1099R – For any retirement account distribution

- 1099SA – Health Savings Distribution

- 1098 – Mortgage interest paid totals $600 or more

- 1042S – Interest greater than $1 to foreign persons

- 5498 – IRA contributions

As a convenience for our business members, the interest paid on all business loans is reported to the IRS. The term “mortgage interest” is listed on the 1098 and includes any interest paid on a business loan for the prior year that totals $600 or more. This may include any real estate taxes if you had an escrow account with us.

The 1098 is issued to the Tax-Reported Owner of the account.

Note: Online tax forms are not available within Premier Treasury Online Banking.