Member Login

- Online Banking

- Premier Treasury Online

*Username

Forgot User ID*Password

Forgot PasswordNot Enrolled Yet?

Set up Online AccessNeed to complete an application?

Join MIDFLORIDA Today!

Experience the benefits of credit union membership, including low fees, great rates and personalized service. Become a member and start banking smarter with us.

Get Started

Investor Checking

Add dividends to your day-to-day banking

If your account balance is $1,000 or more, you could earn more with Investor Checking.

Open at a Branch

At a Glance

Make Your Money Work for You

Earn interest on your money without sacrificing flexibility. With Investor Checking, you can easily manage your day-to-day banking, plus earn dividends on the entire balance with no restrictions or requirements to do so. Or compare this account with other checking options.

Bill Pay

Pay all your bills from one location or schedule them in advance.

Debit card rewards

Earn cash back for yourself or for a local school.

Over 1,300 no-fee ATMs

No surcharge when you use a MIDFLORIDA or Publix Presto! ATM.

Overdraft Coverage

Overdraft protection options are available to help you avoid declined transactions.

Account Benefits

Discover Extra Perks of Your Account

With valuable benefits designed to enhance your banking experience, you'll find managing your finances easier and more rewarding.

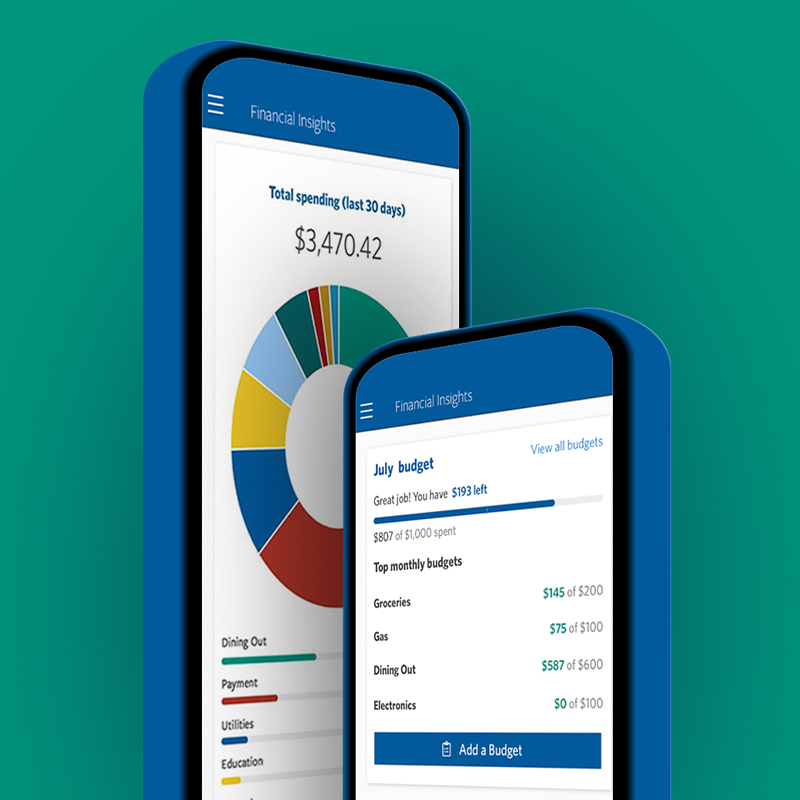

Mobile app

Stay in Control with Our Mobile App

Access your accounts, check balances, and manage transactions with ease, all from the palm of your hand.

Offer Requirements

How to Earn Your $400 Bonus

Open your new Investor Checking account with a minimum deposit of $1,000 and complete the steps below within the first 60 days. Once criteria have been met, you'll receive your bonus within 75 days of account opening.

Set Up direct Deposit

Receive a direct deposit of $4,000 or more to your new checking account. Note: cash app transfers don't qualify.

Set Up Online Access

Enroll in online banking and eStatement to receive paperless statements. Be sure to log in and accept the disclosures.

Use Your Debit Card

Pick up a free debit card from any branch (or have one mailed to you) and use it to make 40 purchases. ATM transactions don't qualify.

Other Products & Services

Explore More Banking Options

We offer a range of valuable products and services designed to meet all your financial needs.

Investor Checking FAQs

Find quick answers to common questions about Investor Checking.

Yes, Investor Checking has a fee of $6 per month, which can be waived by maintaining an average daily balance of $1,000.

The minimum deposit to open an Investor Checking account is $1,000.

Yes, the Investor Checking account has a minimum balance requirement of $1,000.

No, there is no minimum balance required to earn dividends on an Investor Checking account.

1. Offer valid as of December 1, 2025, and may be canceled at any time. MIDFLORIDA Credit Union membership and eligibility requirements apply. See associate for details regarding fees and terms. Freedom Banking, fiduciary and minor accounts excluded. Other terms and conditions apply. To qualify for the $400 incentive, you must open a new Investor Checking account with direct deposit ($4,000 cumulative which must post within 60 days of account opening); accept and open online banking, eStatement, and a debit card; and complete 40 debit card purchase transactions which must post within 60 days of account opening. To qualify for the $200 incentive, you must open a new Investor Checking account with direct deposit ($2,000 cumulative which must post within 60 days of account opening); accept and open online banking, eStatement, and a debit card; and complete 20 debit card purchase transactions which must post within 60 days of account opening. Direct Deposit must be an automated clearing house (ACH) credit of your paycheck, pension or government benefits from your employer or the government; tax refunds, cash transfer app deposits and transfers from another MIDFLORIDA account do not qualify. Annual Percentage Yield is 0.25%. Rates may change after account is opened. Limit one incentive per Social Security number. Past checking account holders and previous recipients of checking account incentives are ineligible. New account must remain open and unrestricted at least 75 days to qualify for the incentive. The incentive will be deposited to the new Investor Checking account within 75 days of account opening after all qualifications have been met and will be reported to the IRS. Minimum to open Investor Checking is $1,000.